BTCC was China’s first bitcoin exchange. Founded in 2011, the exchange grew to become the world’s second largest bitcoin exchange by volume by October 2014. Today, it typically sits in the top 20 exchanges by 24 hour trading volume (at the time of writing, it was sitting in the 19th position).

BTCC doesn’t offer a wide range of pairs, choosing instead to focus on a smaller number of high-volume pairs. The exchange is best known for its BTC/CNY pair (which consists of over 70% of trading volume on the exchange). The next most popular pair is BTC/USD (about 20% of trading volume), followed by pairs like LTC/CNY and LTC/BTC.

The exchange can be found online at two websites: it can be found at BTCC.com for international users, or at BTCChina.com for Chinese users.

7.2

Margin tradingNo (Exchange does not support margin trading)

Margin tradingNo (Exchange does not support margin trading) Trust scoreA

Trust scoreA Beginner friendlyNo (Exchange is complex and difficult for beginners)

Beginner friendlyNo (Exchange is complex and difficult for beginners) Stability4. Very (Exchange is very stable)

Stability4. Very (Exchange is very stable) FiatYes (The Exchange supports Fiat currency as USD, EUR, etc.)

FiatYes (The Exchange supports Fiat currency as USD, EUR, etc.) SafetyA (Very secure)

SafetyA (Very secure) APIYes (API is available for public to use)

APIYes (API is available for public to use) Rest APIYes (The Exchange has Rest API support)

Rest APIYes (The Exchange has Rest API support) WebsocketYes (The Exchange has Websocket support)

WebsocketYes (The Exchange has Websocket support) Mobile appYes (Exchange has a mobile app)

Mobile appYes (Exchange has a mobile app) Credit cardNo (Exchange does not support credit cards)

Credit cardNo (Exchange does not support credit cards) ReferralNo (Exchange does not offer an affiliate program)

ReferralNo (Exchange does not offer an affiliate program) Two factor authentificationYes (The Exchange supports two factor authentication)

Two factor authentificationYes (The Exchange supports two factor authentication) LendingNo (Exchange does not support lending)

LendingNo (Exchange does not support lending) Stop limitYes (Exchange supports stop limit)

Stop limitYes (Exchange supports stop limit) US licenceNo (Exchange don't have US licence for Money transmitter)

US licenceNo (Exchange don't have US licence for Money transmitter) PGP supportNo (Exchange does not have PGP encryption)

PGP supportNo (Exchange does not have PGP encryption)BTCC Limited is based in Hong Kong, although the exchange’s Chinese division (BTCChina) is based in Shanghai. The company was originally founded in Shanghai, but opened the Hong Kong office to cater to international customers.

The company was founded in June 2011. At the time, it was China’s first and only bitcoin exchanges. Today, most of the company’s customers are Chinese. In 2013, BTCC hired CEO Bobby Lee and oversaw the exchange’s rapid expansion. Bobby Lee is a Stanford computer science graduate whose brother founded the Litecoin cryptocurrency.

BTCC made headlines in February 2017 after announcing that it was halting bitcoin and other cryptocurrency withdrawals for one month. The news came one week after Huobi and OKCoin, two of China’s “Big Three” exchanges alongside BTCC, revealed they were freezing cryptocurrency withdrawals in an effort to combat money laundering. China’s central bank had previously ordered the Big Three bitcoin exchanges to take action.

BTCC Advantages

Good reputation, proven security

Founded back in 2011, BTCC is the longest-running bitcoin exchange worldwide. It was the dominant player for CNY/BTC trades before it closed its China operations. It is still considered as one of the best exchanges for trading in popular digital coins like BTC, ETH, ETC and BCC.

BTCC has a 100% track record in security since its inception, as it has not experienced any major hacks in its long history. More than 95% of its users’ digital assets are kept in cold storage with multi-signature controls to minimize the risk and exposure to hacking.

Large trading volume, deep liquidity

Currently, BTCC is rated 16th by 24-hour trading volume according to the data provided by CoinMarketCap and is typically among the top 20 players in this category. This basically means that its users don’t have to worry about insufficient liquidity.

Supports fiat (USD) currency, and Bank Wire and credit card transfersoffered

On BTCC’s USD exchange you can exchange your dollars for Bitcon, or vice versa. Supporting fiat currencies is an advantage, especially for newcomers in the cryptocurrency world, who are yet to buy some digital coins with their real money in traditional currencies. For those, using their credit card or bank account is utterly convenient.

Competitive trading fees

The fees charged by BTCC are relatively competitive, amounting to 0.1% / 0.2% per trade. Typically, exchanges charge 0.20% - 0.25%. However, some of them do not charge market makers, as the latter provide exchanges with liquidity.

Relatively low withdrawal fee

Like most exchanges, BTCC does not charge blockchain deposits. Other than this, certain fees apply to deposits in fiat currency, as well as to withdrawals, depending on the funding method and the currency. While many exchangescharge quite hefty deposit and withdrawal fees, BTCC's commission seem relatively low

BTCC Disadvantages

Not regulated

Like most crypto-exchanges, BTCC is not licensed, nor overseen by any governmental authority. So, this is no big issue.

If you prefer to trade in digital coins via a regulated company, we remind you that you can do that with forex brokers. Make sure you are aware of the differencesbetween trading on an exchange and with forex brokerage beforehand.

Limited instrument portfolio

BTCC doesn’t offer a wide range of pairs for trade, choosing instead to focus on a smaller number of high-volume ones. Currently the available ones on both exchanges are: BTC/USD (constituting 70% of its overall volume), BCC/BTC, ETH/BTC, and ETC/BTC.

If you would rather trade in more exotic cryptocurrencies, check out Bittrex – this major US exchange offers over 190 digital assets for trade.

No margin trading

As a matter of fact, BTCC used to offer margin trading but discontinued this service in the beginning of 2017 after “discussions” with the People’s Bank of China (PBOC). Most cryptocurrency exchanges do not offer leverage, but there are some who do, like Kraken, Quoinex and others. Besides, all forex brokers ffer leveraged trading on cryptocurrency CFDs.

No anonymous trading

Since BTCC Exchange requires its users to verify their identity in order to trade in order to ensure the safety and security of the funds and activities on its platforms. Identity verification is also required in compliance with certain government AML KYC regulations. Verification process can be slow and complicated. Besides, itdefies the initial idea of of Bitcoin to allow anonymous trades.

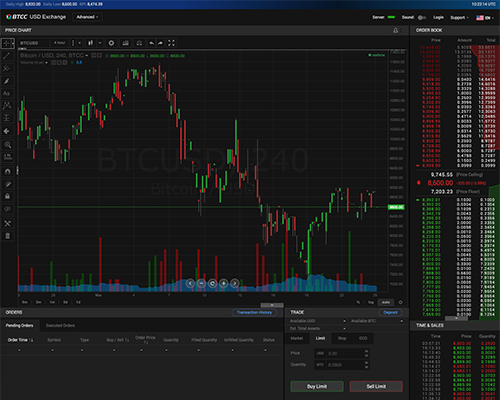

Manuals for BTCC

Most cryptocurrency exchanges do not offer advanced platforms like the most popular forex and CFD trading terminal for MetaTrader 4. Nonetheless, BTCC has chosen a different approach – not only that it offers crypto-to-crypto and crypto-to-fiat trading on different exchanges, but the latter has two different interfaces – basic and professional. The advanced trading user interface offers lots of bells and whistles: wide range of technical indicators, advanced charts, add-ons, etc. Besides, there is WebSocket and FIX API available for professional clients’ trading needs. Of course, BTCC Mobile App is also offered.

Extra Services

In addition to having one of the largest and top-rated mining pools in the world and operating several crypto-exchanges, BTCC offers a service called BTCC Mint. These are titanium coins that can be purchased with BTC and are shipped to all countries except the US.

BTCC also offers its Mobi Digital Currency Wallet, allowing storage, conversion, and transfer of bitcoin and more than 100 currencies, including the United States dollar, the British pound, and the euro.

Review of BTCC

BTCC is the oldest Bitcoin exchange worldwide. It is highly regarded for its reliability, security, deep liquidity and the extra services it provides for its users.

Initially set up in Shanghai in 2011, BTCC was one of the Chinese “Big Three” along with Huobi and OkCoin. Following China’s ICO ban in the country, BTCC shut down its local division (BTCChina). BTCC DAX and BTCC USD exchanges, however, are functioning, and the company operates via its units in the UK and Hong Kong BTCC (UK Limited or XO Market Limited).

None of these companies is formally regulated, but this does not effect the overall reliability of BTCC. Unlike the situation with forex brokers, the legal crypto-exchanges is still unclear in most countries. The important thing is, BTCC complies with governmental instructions – its halted margin trading, and was the first among the “Big Three” to shut down its Chinese operations. More importantly, it keeps clients’ assets in cold storage and has not been hacked during its long years of operation.

Besides, BTCC has a lot of advantages, apart from its reliability: competitive fees, various transfer methods supported, advanced trading platform with mobile app, and some great extra services, such as top-tear mining pool.