Bitstamp is a bitcoin exchange based in Luxembourg. It allows trading between USD currency and bitcoin cryptocurrency. It allows USD, EUR, bitcoin, litecoin, ethereum, ripple or bitcoin cash deposits and withdrawals.

The company was founded as a European-focused alternative to then-dominant bitcoin exchange Mt. Gox. While the company trades in US dollars, it accepts fiat money deposits for free only via the European Union's Single Euro Payments Area, a mechanism for transferring money between European bank accounts. Deposits via credit cards or wires incur a fee.

9.5

iOS: 7.8

Android: 7.8

Margin tradingNo (Exchange does not support margin trading)

Margin tradingNo (Exchange does not support margin trading) Trust scoreA+

Trust scoreA+ Beginner friendlyYes (Exchange is simple for beginners)

Beginner friendlyYes (Exchange is simple for beginners) Stability4. Very (Exchange is very stable)

Stability4. Very (Exchange is very stable) FiatYes (The Exchange supports Fiat currency as USD, EUR, etc.)

FiatYes (The Exchange supports Fiat currency as USD, EUR, etc.) Support speedFew week (Technical support is slow to respond within a few weeks)

Support speedFew week (Technical support is slow to respond within a few weeks) SafetyA (Very secure)

SafetyA (Very secure) APIYes (API is available for public to use)

APIYes (API is available for public to use) Rest APIYes (The Exchange has Rest API support)

Rest APIYes (The Exchange has Rest API support) WebsocketYes (The Exchange has Websocket support)

WebsocketYes (The Exchange has Websocket support) Mobile appYes (Exchange has a mobile app)

Mobile appYes (Exchange has a mobile app) Credit cardYes (Credit card support)

Credit cardYes (Credit card support) ReferralNo (Exchange does not offer an affiliate program)

ReferralNo (Exchange does not offer an affiliate program) Two factor authentificationYes (The Exchange supports two factor authentication)

Two factor authentificationYes (The Exchange supports two factor authentication) Withdrawal limitNo limit (Exchange don't have any limit for withdrawals)

Withdrawal limitNo limit (Exchange don't have any limit for withdrawals) Verification timeFew Days (The Exchange verifies the user within a few days)

Verification timeFew Days (The Exchange verifies the user within a few days) LendingNo (Exchange does not support lending)

LendingNo (Exchange does not support lending) Stop limitYes (Exchange supports stop limit)

Stop limitYes (Exchange supports stop limit) US licenceNo (Exchange don't have US licence for Money transmitter)

US licenceNo (Exchange don't have US licence for Money transmitter) PGP supportNo (Exchange does not have PGP encryption)

PGP supportNo (Exchange does not have PGP encryption)The company is headed by CEO Nejc Kodrič, a widely known member of the bitcoin community, who co-founded the company in August 2011 with Damijan Merlak in his native Slovenia, but later moved its registration to the UK in April 2013, then to Luxembourg in 2016. Bitstamp outsourced certain operations to the UK due to the lack of adequate financial and legal services in Slovenia.

When incorporating in the United Kingdom, the company approached the UK's Financial Conduct Authority for guidance, but was told that bitcoin was not classed as a currency, so the exchange was not subject to regulation. Bitstamp says that it instead regulates itself, following a set of best practices to authenticate customers and deter money laundering. In September 2013, the company began requiring account holders to verify their identity with copies of their passports and official records of their home address. In April 2016, the Luxembourgish government granted a license to Bitstamp to be fully regulated in the EU as a payment institution, allowing it to do business in all 28 EU member states.

In December 2016 Bitstamp started a public funding campaign on the BnkToTheFuture investment website. In July 2017, Swissquote partnered with Bitstamp to launch bitcoin trading.

In 2017 Chicago Mercantile Exchange has created the CME CF Bitcoin Reference Rate (BRR) which serves as a once-a-day reference rate of the US dollar price of Bitcoin. This price is set through Bitstamp, GDAX, itBit and Kraken.

Short interview of Nejc Kodrič, Bitstamp CEO

Strengths of Bitstamp

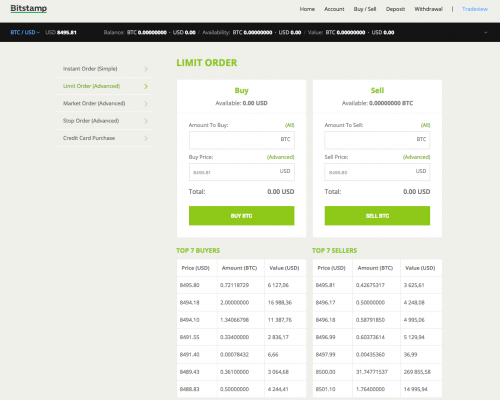

- Offers a very simple buy/sell user interface, combined with advanced trading pages with detailed graphs, and trading parameters.

- Has significant trading volumes and therefore represents a good exchange for large purchases or sales.

- Supports buying of cryptos using debit and credit cards (recently extended to multiple countries).

- Regulated by the CSSF (Commission de Surveillance du Secteur Financier) in Luxembourg - thus good standards for keeping users’ funds more secure.

- Will support trading of Bitcoin Cash & will allocate all owed BCH tokens to customers.

- Cheaper & more efficient than person-to-person exchanges such as Localbitcoins.

- Despite a significant theft of its reserves, Bitstamp has maintained a strong reputation and has not suffered from prolonged trading shutdowns. A similar reputation & clientele recovery happened with Bitfinex (major Hong Kong exchange).

Weaknesses of Bitstamp

- As with all centralized exchanges, private keys are controlled by the exchange operators.

- Unlike Coinbase's free 10$ credit for new traders, Bitstamp offers no such freebees to attract market share.

- Account verification takes more than three days. Similar wait times can be expected on Coinbase, CEX, and Kraken.

- Users are required to share an invasive amount of personal information when transactions reach a threshold (~10k usd)

- Although extra locations have been added, service is not available in all countries. Bitstamp competitor Coinmama offer similar credit card purchases to users anywhere in the world.

- Only supports only four cryptocurrencies & slow to add new major altcoins such as Bitcoin Cash & Ethereum. Compared to competitors such as Kraken, Bitstamp has been slow to add popular coins.

- A long list of unusual fees are applied to user accounts. However fees remain significantly cheaper than exchanges like CEX or Coinmam

Manuals for Bitstamp

First thing you need to do is transfer some money into your Bitstamp account. In order to do this, you must be logged into your Bitstamp account, go to deposit section and select preferred method of transferring funds. You will be given a unique 11 digit reference code and our account information where your funds must go. Once we receive your deposit we will credit your account and then you can start purchasing bitcoins right away. Buying bitcoins is easy. You must go to trade section and place instant buy order which will automatically buy bitcoins at lowest price offered on the market. You can also place limit order, where you will need to set price on which you are willing to buy bitcoins.

Security rating of Bitstamp

Main Security Features

Like most first-generation centralized exchanges, Bitstamp holds user’s private keys on its platform. Users must trust the company to secure and safeguard their digital coins. This means users also must trust those in charge of their private keys to remain honest.

Meanwhile, users access funds through accounts using passwords and two-factor authentication (2FA). The history of cryptocurrencies has shown that you should avoid entrusting third parties with your private keys. It is therefore a good idea, immediately following a purchase, to move your crypto assets to wallets that are 100% under your control. Experts always recommend bringing your holdings onto exchange platforms only when you are ready to sell.

Bitstamp presents their security features from the moment you register an account. After you fill out the registration form, an email is sent containing a customer ID and password to your inbox. You use the ID as your username, and you should change your password immediately the first time you sign in.

Before you will be allowed to trade on the platform, you must also verify the account by providing your full name, postal address and date of birth. To authenticate this information, Bitstamp requires you to upload a government-issued ID and a no more than three-months-old utility bill to prove place of residence.

The document scans should be of high quality (colour images, 300 dpi resolution or higher), visible in their entirety and current (not expired). After you submit proof of ID, it takes three days for Bitstamp support to approve your application.

Bitstamp - Safety report

Security breaches

Bitstamp has experienced one minor & one major security incident since its inception. In February 2014, it was the target of a compromising distributed denial of service attack. The exchange suspended withdrawals for some users for two days to prevent hackers from accessing private keys and cashing out.

The attackers blackmailed Bitstamp and demanded 75 bitcoins in ransom. The company refused to pay and cited a policy of non-negotiation with criminals.

A year later, in January 2015, an attacker breached the exchange’s security and stole about 19,000 bitcoins. The thieves used Skype and email communications with employees to introduce malware into Bitstamp’s system.

The malware retrieved the private keys of the company’s hot wallets. The news only surfaced six months later when someone leaked an internal report about the hack. Bitstamp declined to acknowledge its authenticity. Instead, they successfully requested the document be taken down from the platform on which it was published.