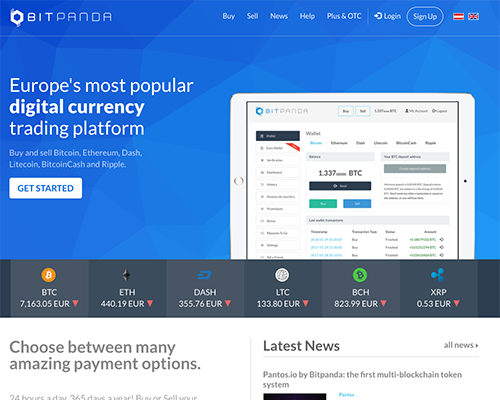

Bitpanda GmbH is an Austrian start-up company that specialises in selling and buying Bitcoins and other cryptocurrencies. It was founded in October 2014 after a long development phase in coordination with the local authorities. The three founding members are Bitcoin enthusiasts and had personally experienced how hard it was to acquire Bitcoin in the EU. This deficiency in the market led to the idea of Bitpanda.

7.2

Margin tradingNo (Exchange does not support margin trading)

Margin tradingNo (Exchange does not support margin trading) Trust scoreA

Trust scoreA Beginner friendlyNo (Exchange is complex and difficult for beginners)

Beginner friendlyNo (Exchange is complex and difficult for beginners) Stability4. Very (Exchange is very stable)

Stability4. Very (Exchange is very stable) FiatYes (The Exchange supports Fiat currency as USD, EUR, etc.)

FiatYes (The Exchange supports Fiat currency as USD, EUR, etc.) APIYes (API is available for public to use)

APIYes (API is available for public to use) Rest APIYes (The Exchange has Rest API support)

Rest APIYes (The Exchange has Rest API support) WebsocketNo (The Exchange does not have Websocket)

WebsocketNo (The Exchange does not have Websocket) Mobile appNo (Exchange does not have a mobile app)

Mobile appNo (Exchange does not have a mobile app) Credit cardYes (Credit card support)

Credit cardYes (Credit card support) ReferralNo (Exchange does not offer an affiliate program)

ReferralNo (Exchange does not offer an affiliate program) Two factor authentificationYes (The Exchange supports two factor authentication)

Two factor authentificationYes (The Exchange supports two factor authentication) LendingNo (Exchange does not support lending)

LendingNo (Exchange does not support lending) Stop limitNo (Exchange does not support stop limit)

Stop limitNo (Exchange does not support stop limit) US licenceNo (Exchange don't have US licence for Money transmitter)

US licenceNo (Exchange don't have US licence for Money transmitter) PGP supportNo (Exchange does not have PGP encryption)

PGP supportNo (Exchange does not have PGP encryption)It appears to be more of a payments platform for cryptocurrency versus a trading platform. If you may be looking to gain exposure to bitcoin or major altcoins and possibly hold for a while, this platform, which is fully automated, could be the one for you.

Bitpanda’s management team includes co-founder Eric Demuth, co-CEO Paul Klanschek and CTO Christian Trummer. They were inspired to launch Bitpanda after realizing the challenges associated with purchasing bitcoin in the EU, and as a result they have a focus on simplicity. The exchange, whose parent company is Bitpanda Gmph, was founded in 2014 and launched in cooperation with local authorities.

Here’s an interview Bitpanda’s management team about the Pantos ICO (which is discussed in greater detail below.)

Austrian central bankers have taken a hardline stance on cryptocurrencies, grouping them in the same camp as casinos. But Bitpanda has managed to solidify its presence by inking partnerships with the likes of Oesterreichische Post AG, which is the country’s state-owned postal service, where the exchange sells bitcoin vouchers of EUR 50, EUR 100 and EUR 500 across nearly 2,000 locations for wider acceptance. The vouchers can be redeemed for bitcoin, Ethereum, Ripple, Dash, Bitcoin Cash or Litecoin.

Bitpanda Pros

- Operates throughout much of Europe

- Automated exchange so trades are completed “within seconds,” according to the exchange.

- Supports BTC and several altcoins, including BTC, ETH, DASH, LTC, BCH and XRP

- Accepts multiple payment options including credit cards for accounts with the highest level of ID verification

- They implemented SegWit in November 2018, which makes them more competitive on fees with other exchanges. BitPanda runs 100% on SegWit.

- They offer transaction batching, which means they process transactions in batches. They say this leads to lower transaction fees. As a result of SegWit and batching, Bitpanda says users can save as much as 80% on transactions.

- Cold storage for added security of user accounts

- Speed – the exchange says users can order coins in as fast as two minutes

Bitpanda Cons

- Users complain of non-transparent and “slightly higher” fees versus competitors

- Users want more coins, such as NEO

- Some users complain of fees that are too high, saying Bitpanda has “lost a customer” as a result.

- Some customers complain of support tickets that have been left unanswered for weeks

- No margin trading

- Users are begging for more coins, such as IOTA.

- Not open to US investors

Manuals for Bitpanda

Security rating of Bitpanda

For security, Bitpanda recommends the following: two-factor authentication (2FA), for which they recommend Google Authenticator or Authy, a “strong and unique password” and applying 2FA to email.

The exchange boasts the following security features

- SSL Certificate

- Two-factor authentication (2FA)

- Encrypted user data

- Trezor for cold storage

- Separate web and wallet servers

- SMS verification

The exchange has been around since 2014 and they haven’t suffered any known security breaches, so if history is any teacher that is a positive sign. It’s not that users haven’t run into issues accessing their funds, such as in the case with BCH after the bitcoin fork, but the exchange explained that users didn’t all follow the steps they had provided (more on this later.)

There are no chargebacks if a transaction is inadvertently sent to an incorrect wallet address.

Bitpanda execs want to see BTC regulated like gold, whose regulatory requirements are simpler versus securities. Bitpanda’s co-CEO Eric Demuth told Bloomberg: “Regulation provides us with more legitimacy. We’ve wanted to be regulated, but so far have been told that we cannot be.”

Review of Bitpanda

Bitpanda is a simple platform, but it’s one that hasn’t been plagued with any security breaches. While the exchange seems appropriate for someone who is looking to buy and hold or convert from fiat money or another coin, their lofty transaction limits of EUR 1 million or more suggest they’re catering to even the most sophisticated investors. Certainly, if you’re based in Austria or just about anywhere in the European Union, not to mention London most recently, this platform is a good and secure option for simple buy and sell transactions. But fees are higher than average.