Founded by HDR Global Trading Limited (which in turn was founded by former bankers Arthur Hayes, Samuel Reed and Ben Delo) in 2014, BitMEX is a trading platform operating in Hong Kong and registered in the Seychelles.

Meaning Bitcoin Mercantile Exchange, BitMEX is one of the largest Bitcoin trading platforms currently operating, with a daily trading volume of over 35,000 BTC and over 540,000 accesses monthly and a trading history of over $34 billion worth of Bitcoin since its inception.

8.5

Margin tradingNo (Exchange does not support margin trading)

Margin tradingNo (Exchange does not support margin trading) Trust scoreA

Trust scoreA Beginner friendlyNo (Exchange is complex and difficult for beginners)

Beginner friendlyNo (Exchange is complex and difficult for beginners) Stability4. Very (Exchange is very stable)

Stability4. Very (Exchange is very stable) FiatYes (The Exchange supports Fiat currency as USD, EUR, etc.)

FiatYes (The Exchange supports Fiat currency as USD, EUR, etc.) APIYes (API is available for public to use)

APIYes (API is available for public to use) Rest APIYes (The Exchange has Rest API support)

Rest APIYes (The Exchange has Rest API support) WebsocketYes (The Exchange has Websocket support)

WebsocketYes (The Exchange has Websocket support) ReferralYes (Exchange offers an affiliate program)

ReferralYes (Exchange offers an affiliate program) LendingNo (Exchange does not support lending)

LendingNo (Exchange does not support lending) Stop limitYes (Exchange supports stop limit)

Stop limitYes (Exchange supports stop limit) US licenceNo (Exchange don't have US licence for Money transmitter)

US licenceNo (Exchange don't have US licence for Money transmitter) PGP supportYes (Exchange supports PGP encryption)

PGP supportYes (Exchange supports PGP encryption)Bitmex is the leading bitcoin margin trading site. Users can trade cryptocurrency derivatives with up to 100x leverage. Pairs include BTC/USD, Yen, Monero, Ripple, Dash, and Ethereum. Bitmex CEO Arthur Hayes has used his experience as an equity derivatives trader for Deutsche Bank to design, build, and maintain exactly the type of platform that users are looking for. Granted that this platform is for experienced and seasoned traders. Beginners should avoid trading coins here without knowing the implied volatility risks.

Pros

-

Leading platform for bitcoin derivatives and margin trading

-

Relatively functional user experience thanks to crafty designing

-

Up to 100x leverage

Cons

-

With such high leverage it's easy to overlook implied risk factor

Manuals for BitMEX

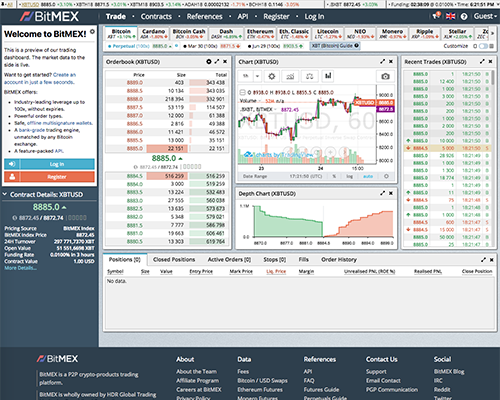

As you can see on the right side we see the last transactions made, in the middle we have the graph, and the left pane is actually the interesting one, here we open our positions.

Quantity = position size in US dollars.

Limit Price = The price we set in order to open the position.

Cost = the total price of the position.

Order Value = The total value of the position (if the leverage is set to 1, then it’s equal to the cost minus fees).

Available Balance = Balance we have in bitcoin.

Before opening the position, we will define the leverage. If this is your first trade I would recommend leaving it on 1, that is, with no leverage at all.

Leverage means position cost divides by the same ratio. For example, if we set the leverage to be times 5, then we expect the cost of the position to be reduced by the same ratio – divided by 5. Which means it will be reduced by five times. This basically allows us to trade on bitcoins we borrow from the exchange. Keep in mind - the higher the leverage will be, the more we will have to borrow from BitMex and therefore the fees will increase.

Another thing you need to know about is the liquidation price. This is the price value at which Bitmex will close the position, or liquidate it. Bitmex can’t afford to lose, and in order not to lose the money we borrowed for the position, the position will automatically close once we lose the amount of bitcoins that belongs to us.

Placing a new position

We do it using BUY, means long position - when we believe that the value of Bitcoin will increase, or SELL – short position - when we actually benefit from the decrease of the Bitcoin’s value.

We will set the buying price to be higher than the market price because we want the position to open immediately (means buy from the sellers) or lower than the market price if we want to join the buy wall and wait for a seller.

We need to confirm the position in the popping screen - notice we can see when Bitmex is estimated to liquidate the position.

Now we see our position: we have here the entry price, Unrealized PNL is the estimated profit and it’s calculated according to this Mark Price, we also see the real Liquidation Price. In case we close part of the position, we will see the gain or loss on the Realized PNL tab.

Two ways for closing our position

The first is by setting a SELL command: suppose we want the position to close at price of 4200$, so we will create an inverse command to our original position with the same quantity.

Or if we want to close the position immediately – there is this red button here - Market. The order will be released to the market and will close at the best available price. On Bitmex there are more advanced options such as stop-limit.

Security rating of BitMEX

BitMEX is widely considered to have strong levels of security. The platform uses multi-signature deposits and withdrawal schemes which can only be used by BitMEX partners. BitMEX also utilises Amazon Web Services to protect the servers with text messages and two-factor authentication, as well as hardware tokens.

BitMEX also has a system for risk checks, which requires that the sum of all account holdings on the website must be zero. If it’s not, all trading is immediately halted. As noted previously, withdrawals are all individually hand-checked by employees, and private keys are never stored in the cloud. Deposit addresses are externally verified to make sure that they contain matching keys. If they do not, there is an immediate system shutdown.

Review of BitMEX

There would appear to be few complaints online about BitMEX, with most issues relating to technical matters or about the complexities of using the website. Older complaints also appeared to include issues relating to low liquidity, but this no longer appears to be an issue.

BitMEX is clearly not a platform that is not intended for the amateur investor. The interface is complex and therefore it can be very difficult for users to get used to the platform and to even navigate the website. However, the platform does provide a wide range of tools and once users have experience of the platform they will appreciate the wide range of information that the platform provides.