ACX is ambitious, awesome, advanced and Australian. Since 2013, we've taken the complexity out of trading and owning digital currencies for everyone in Australian and beyond. Our goal at ACX is to provide the highest quality, instant and simplified purchasing experience for customers looking to acquire Blockchain Backed assets, starting with Bitcoin.

6.2

Margin tradingNo (Exchange does not support margin trading)

Margin tradingNo (Exchange does not support margin trading) Trust scoreB

Trust scoreB Beginner friendlyNo (Exchange is complex and difficult for beginners)

Beginner friendlyNo (Exchange is complex and difficult for beginners) Stability2. Most (Exchange has occasional outages)

Stability2. Most (Exchange has occasional outages) FiatYes (The Exchange supports Fiat currency as USD, EUR, etc.)

FiatYes (The Exchange supports Fiat currency as USD, EUR, etc.) APIYes (API is available for public to use)

APIYes (API is available for public to use) Rest APIYes (The Exchange has Rest API support)

Rest APIYes (The Exchange has Rest API support) WebsocketYes (The Exchange has Websocket support)

WebsocketYes (The Exchange has Websocket support) Mobile appNo (Exchange does not have a mobile app)

Mobile appNo (Exchange does not have a mobile app) Credit cardNo (Exchange does not support credit cards)

Credit cardNo (Exchange does not support credit cards) ReferralNo (Exchange does not offer an affiliate program)

ReferralNo (Exchange does not offer an affiliate program) Two factor authentificationYes (The Exchange supports two factor authentication)

Two factor authentificationYes (The Exchange supports two factor authentication) Withdrawal limitBy degree of verification (Exchange has a withdrawals limit)

Withdrawal limitBy degree of verification (Exchange has a withdrawals limit) LendingNo (Exchange does not support lending)

LendingNo (Exchange does not support lending) Stop limitNo (Exchange does not support stop limit)

Stop limitNo (Exchange does not support stop limit) US licenceNo (Exchange don't have US licence for Money transmitter)

US licenceNo (Exchange don't have US licence for Money transmitter) PGP supportNo (Exchange does not have PGP encryption)

PGP supportNo (Exchange does not have PGP encryption)ACX Advantages

- One of the large Australian bitcoin exchanges by volume. - In the short period since its launch in 2016, ACX has managed to rank among the largest Australian exchanges by volume. At the time of writing this review, its 24-hour bitcoin volume was 1,213.3620 BTC (over AUD 12 mln)

- Instrument portfolio: ACX offers trading in Bitcoin, Bitcoin Cash, Ether and the relatively new alt-coin Hcash (HSR) against the Australian dollar. Bitcoin and Ether are the most popular cryptocurrencies and are responsible for the larger part of the cryptocurrency trading volume globally.

- Zero trading fees. - Most cryptocurrency exchanges charge a trading commission, but not ACX.

- 1% withdrawal fee. ACX charges a 1% withdrawal fee for fiat currency to a bank account. This, coupled with the zero trading commissions, makes ACX quite attractive, considering that most exchanges charge both trading commissions and deposit and withdrawal fees, often quite hefty.

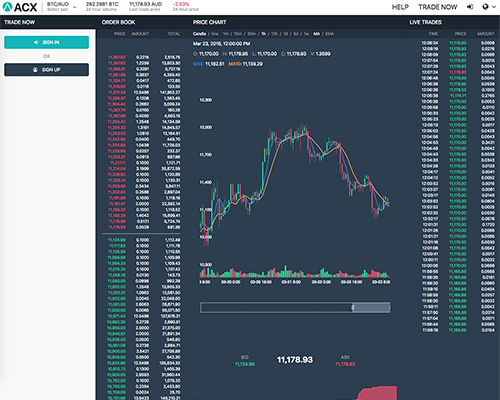

- Trading platform. Even though similarly to most cryptocurrency exchanges ACX does not offer trading platforms like the ones usually provided by the forex brokers, with all the bells and whistles, the platform of ACX has the most necessary features. It offers candlestick price charts, order book and the option to place and cancel already opened orders.

ACX Disadvantages

- Not regulated. When it comes to cryptocurrency exchanges, the lack of regulation is relative, as most countries have not come up with a legislative framework on the matter yet.

- Relatively small cryptocurrency selection. - We have listed the Bitcoin and Ether trading in the advantages section, but there are Australian exchanges like BTC Markets and Coinspot who have longer alt-coin instrument list.

- Does not offer leveraged trading in cryptocurrencies. - As a matter of fact, most cryptocurrency exchanges do not offer this, but there are some who do, like Kraken, GDAX (institutional), CexIo, Quoinex. There are also forex brokers who offer leveraged trading on cryptocurrency CFDs.

- No anonymity. Even though most traders are not bothered by the customer verification requirements of the exchanges, the process can be slow and cumbersome. ACX says its KYC procedure takes 2 business days and requires a lot of documents. Besides, the identification requirements defy the initial purpose of cryptocurrencies to provide anonymity.

- Supports withdrawals to Australian bank accounts only. This in essence means it is next to impossible for clients outside the country to trade on ACX.

- Accepts only deposits via bank accounts (from Australian banks). Bank deposits, unlike credit/debit card payments, which are almost instant, take between 1-3 business days to be processed. There, however, are crypto exchanges who accept card payments. Some also accept fiat currency payments via online payment systems like Paypal.

- Withdrawal limits. ACX has daily withdrawal limits, both for individual and corporate accounts.

For individual accounts: A$10,000, US$10,000 or BTC 100. For business accounts: A$30,000, US$30,000 or BTC 200.

Manuals for ACX

Security rating of ACX

ACX has done a decent job with the security of its exchange. It does offer 2-factor authentication, which has become one of the safest ways to interact with excanges these days to keep your accounts secure. But ACX does state that it keeps the storage of funds online, which for many may be a huge draw back due to the propensity of getting hacked.

Review of ACX

Apparently ACX has started pretty well and has managed to become one of the leading Australian cryptocurrency exchanges. It boasts a global network of order books that provides deep liquidity and to be the largest Australian cryptocurrency exchange by volume.

Like we already noted, it is not regulated, but this is not entirely a problem for cryptocurrency exchanges in general, as most countries still do not have specific legal framework on the matter. On the other hand, we notice that ACX has strict KYC rules and requirements and have not come across client complaints for being ripped off, so the exchange has good reputation.

An advantage of ACX are the relatively attractive trading conditions with the 0 trading commission and the fixed 1% fee for withdrawal of fiat currency to a bank account.

What we do not like about ACX is that it only works with Australian bank accounts and does not provide other deposit and withdrawal options for fiat currencies. This is a major inconvenience and practically makes it next to impossible for people residing outside of Australia to use ACX’s services.

Another disadvantage of ACX is the relatively small selection of cryptocurrencies, compared to some of its Australian peers.